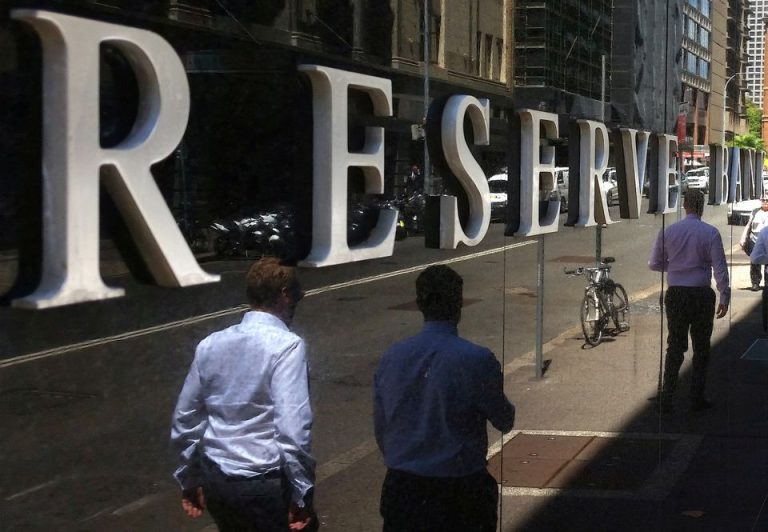

SYDNEY, (Reuters) – The head of Australia’s central bank on Wednesday warned of dire consequences of not containing inflation, which is running at three-decade highs.

Appearing before members of parliament, Reserve Bank of Australia Governor Philip Lowe said one risk was that the bank might not have done enough on interest rates.

“Inflation at the moment, 7.8%, is way too high. It needs to come down. That’s our primary consideration,” said Lowe. “Raising interest rates has always been unpopular … but our job is to make sure inflation comes down and hopefully preserve the gains of employment that we have made.”

“We want to get inflation down because it’s dangerous. It’s corrosive, it hurts people, it damages income inequality and it if stays high it leads to higher interest rates and more unemployment.”

Since the central bank began raising interest rates last year, its policy rate has already risen 325 basis points to a decade high of 3.35%. After the latest rise last week, it flagged more increases to contain inflation.

Markets responded to the central bank’s statement by raising the expected peak for the policy rate to around 4.2% from 3.6% a month before, implying at least three more rises to come.