The consumer price inflation has increased significantly in the first seven months of the current fiscal year.

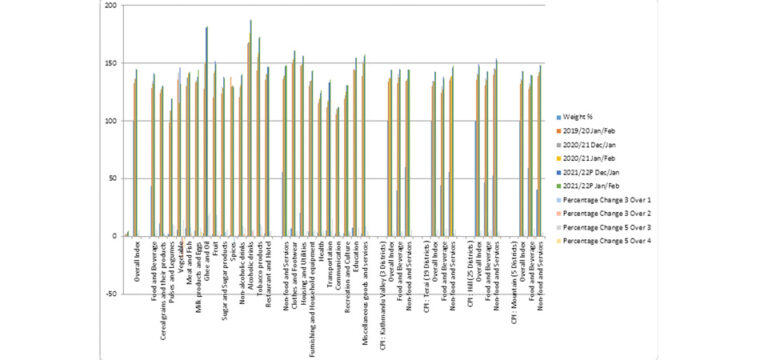

The y-o-y consumer price inflation stood at 5.97 per cent in the seventh month of the current fiscal year 2021/22 compared to 2.70 per cent a year ago.

Food and beverage inflation stood at 6.00 per cent whereas non-food and service inflation stood at 5.96 per cent in the review month, according to a macroeconomic and financial report published by Nepal Rastra Bank (NRB) Friday.

Under the food and beverage category, the prices of ghee and oil, vegetable, and pulses and legumes sub-categories rose by 20.68 per cent, 14.07 per cent and 9.36 per cent respectively on y-o-y basis.

Likewise, under the non-food and services category, the prices of transportation, education and furnishing and household equipment subcategories rose by 15.87 per cent, 7.86 per cent and 5.92 percent respectively on y-o-y basis.

In the review month, the Kathmandu Valley, Terai, Hill and Mountain witnessed 5.47 per cent, 6.50 per cent, 5.32 per cent and 5.97 per cent inflation respectively.

Inflation in these regions was 2.12 per cent, 2.78 per cent, 3.30 per cent and 2.05 per cent respectively a year ago.

The y-o-y wholesale price inflation stood at 10.34 per cent in the review month compared to 6.12 per cent a year ago, the report said.

The y-o-y wholesale price of consumption goods, intermediate goods and capital goods increased by 12.09 per cent, 9.92 per cent and 7.00 per cent respectively.

The y-o-y wholesale price of construction materials has increased by 16.61 per cent in the review month.

The y-o-y salary and wage rate index increased by 5.72 per cent in the review month. Such a growth was 1.77 per cent a year ago.

In the review month, salary index and wage rate index increased by 9.44 per cent and 4.67 per cent respectively.

BoP deficit widens to Rs. 247 billion

Meanwhile, balance of Payments (BOP) remained at a deficit of Rs. 247.03 billion in the review period against a surplus of Rs. 97.36 billion in the same period of the previous year.

In the US dollar terms, the BoP remained at a deficit of 2.07 billion in the review period against a surplus of 817.6 million in the same period of the previous year.

Likewise, the current account remained at a deficit of Rs.413.86 billion in the review period compared to a deficit of Rs.104.39 billion in the same period of the previous year.

In the US dollar terms, the current account registered a deficit of 3.47 billion in the review period compared to a deficit of 892.1 million in the same period last year.

In the review period, capital transfer decreased by 19.4 per cent to Rs.6.31 billion and net foreign direct investment (FDI) increased by 80.6 per cent to Rs.16.29 billion.

Remittance drops by 4.9%

Remittance inflows decreased by 4.9 per cent to Rs.540.12 billion in the review period against an increase of 10.9 per cent in the same period of the previous year.

In the US dollar terms, remittance inflows decreased by 5.8 per cent to 4.53 billion in the review period against an increase of 6.8 per cent in the same period of the previous year.

Number of Nepali workers (institutional and individual-new and legalised) taking approval for foreign employment increased significantly to 200,102 in the review period, said NRB.

It had decreased 85.4 per cent in the same period of the previous year.

The number of Nepali workers (Renew entry) taking approval for foreign employment increased by 265.9 per cent to 152,325 in the review period.

Net transfer decreased by 4.2 per cent to Rs.603.73 billion in the review period.

Foreign currency reserves declines to Rs. 1173 billion

In the meantime, gross foreign exchange reserves decreased by 16.2 per cent to Rs.1173.02 billion in mid-February 2022 from Rs.1399.03 billion in mid-July 2021.

In the US dollar terms, the gross foreign exchange reserves decreased by 17 per cent to 9.75 billion in mid-February 2022 from 11.75 billion in mid-July 2021.

Of the total foreign exchange reserves, reserves held by NRB decreased by 17.7 per cent to Rs.1024.60 billion in mid-February 2022 from Rs.1244.63 billion in mid-July 2021.

Reserves held by banks and financial institutions (except NRB) decreased by 3.9 per cent to Rs.148.42 billion in mid-February 2022 from Rs.154.39 billion in mid-July 2021.

The share of Indian currency in total reserves stood at 24.2 per cent in mid-February 2022.

Based on the imports of seven months of 2021/22, the foreign exchange reserves of the banking sector are sufficient to cover the prospective merchandise imports of 7.4 months, and merchandise and services imports of 6.7 months, said the report.

Source : TRN,