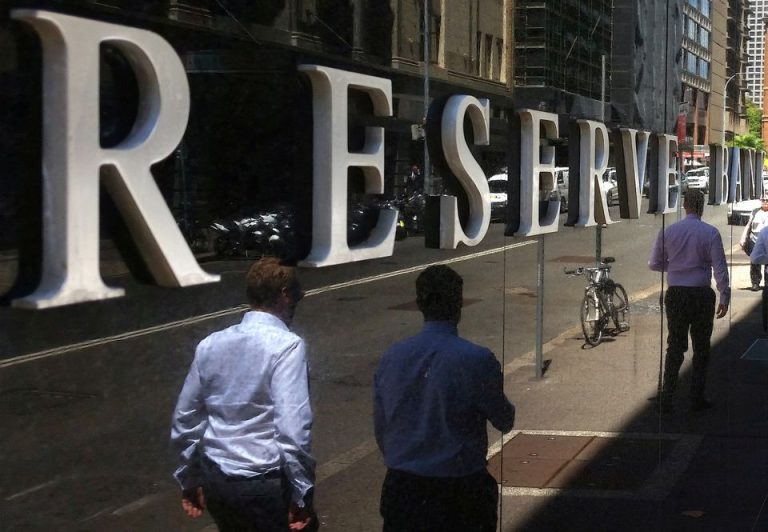

SYDNEY, (Reuters) – Australia’s central bank raised its cash rate 25 basis points to a decade-high of 3.35% on Tuesday and reiterated that further increases would be needed, a more hawkish policy tilt than many had expected.

Wrapping up its February policy meeting, the Reserve Bank of Australia (RBA) also dropped previous guidance that it was not on a pre-set path and forecast inflation would only return to the top of its target range of 2-3% by mid-2025. Markets were surprised by the hawkish tone of the RBA which shattered any expectations of an imminent pause to the tightening campaign. Futures market has priced in a peak rate of 3.9%, implying at least two more rate hikes, compared with 3.75% before the decision.

The local dollar shot up to $0.6940, extending earlier gains, while three-year government bond yields jumped 15 basis points to 3.243%. “The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary,” governor Philip Lowe said in a statement.

Markets had expected a quarter-point move, with some risk of a bigger rise given recent inflation data had surprised on the high side. This was the ninth hike since last May, lifting rates by a total of 325 basis points. Lowe said that core inflation had been higher than expected, with the trimmed mean gauge accelerating to 6.9% last quarter from a year ago, above the central bank’s previous forecast of 6.5%.

Inflation is expected to decline to 4.75% this year and only slow to around 3% by mid-2025, according to the RBA’s latest forecasts.

The RBA also expects economic growth to average around 1.5% over 2023 and 2024.

The interest rate increases so far – including Tuesday’s move – will add over A$900 a month in repayments to the average A$500,000 mortgage, according to RateCity, a deadweight for a population that holds A$2 trillion ($1.3 trillion) in home loans.

Housing prices fell for the ninth straight month in January, with prices in Sydney and Melbourne down about 10% from a year ago.

There are signs that consumers are finally pulling back on spending as cost of living surges and rate increases bite. Australian retail sales recorded the biggest drop in more than two years in December.

The next big test is the wage growth report later this month, which analysts expect to be another strong quarter.